All Categories > Getting Started > How the Finance Planner for Creatives is Structured

How the Finance Planner for Creatives is Structured

This Finance Planner for Creatives was designed to help you manage your income, expenses, and financial goals with clarity and ease—without the overwhelm of complicated apps, and to give you unique insights and charts based on your financial situation. Here's a breakdown of how the key sections are organized and how they work together.

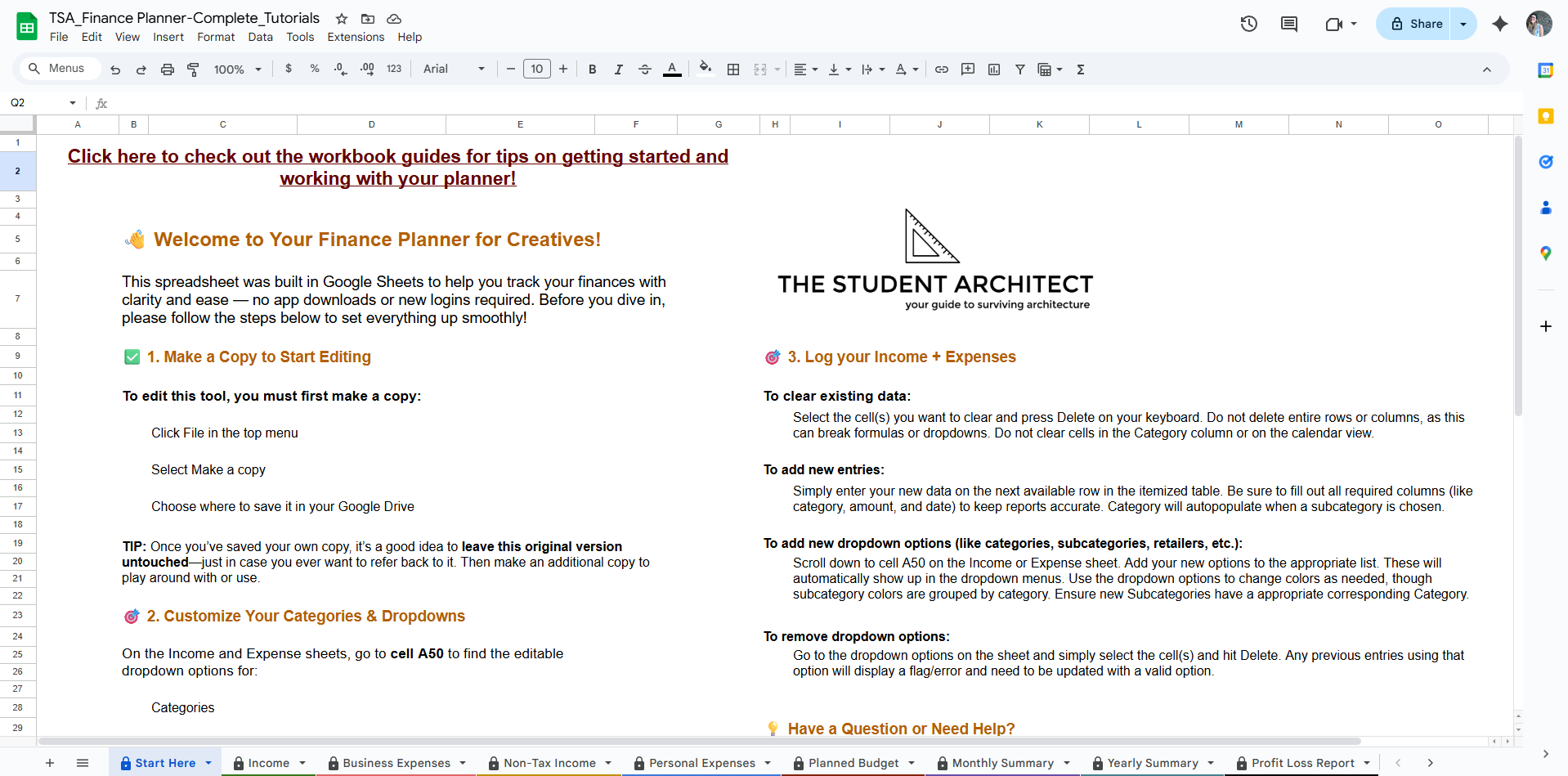

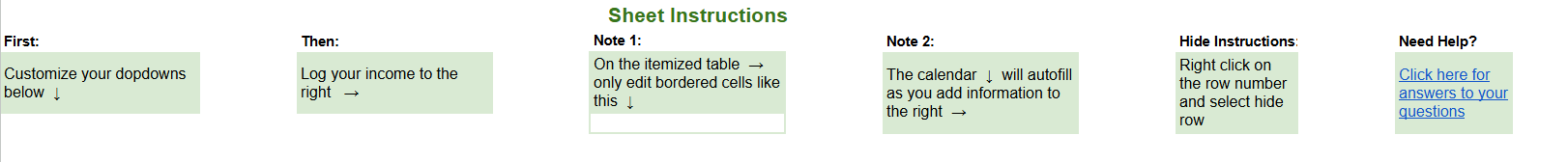

Start Here

This is your welcome page with setup instructions, quick tips, and helpful links. Start by making a copy of the planner and renaming it for your records (e.g. “Finance Planner – Original”).

Income + Expense Sheets

These four sheets are the core of your financial tracking—designed to separate and organize your finances for better clarity and planning:

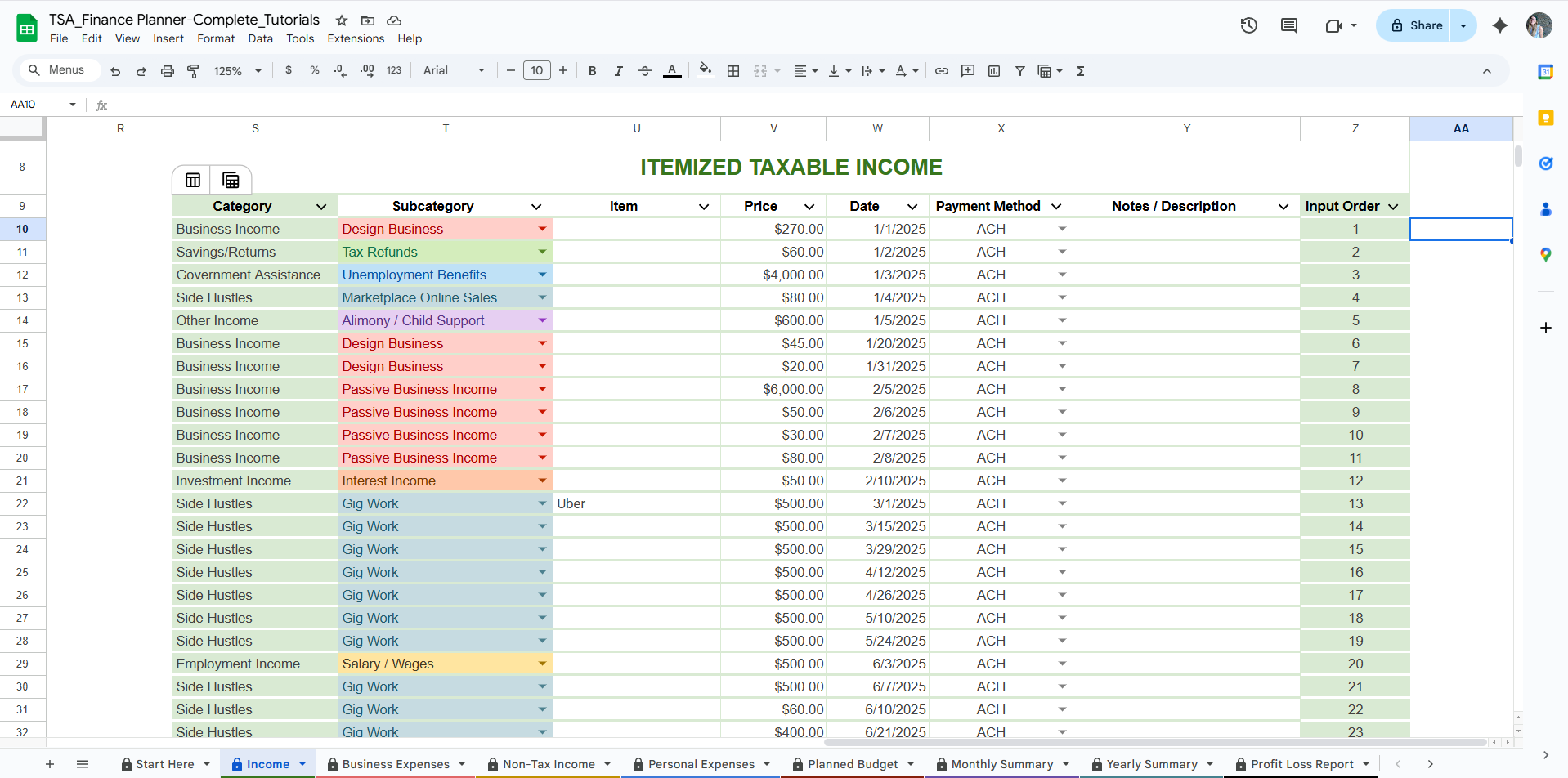

Income Sheets

Taxable Income: Track earnings that you'll report on your taxes—like freelance projects, client payments, or your day job.

Non-Taxable Income: Log income that isn’t subject to tax, such as gifts, reimbursements, or certain grants.

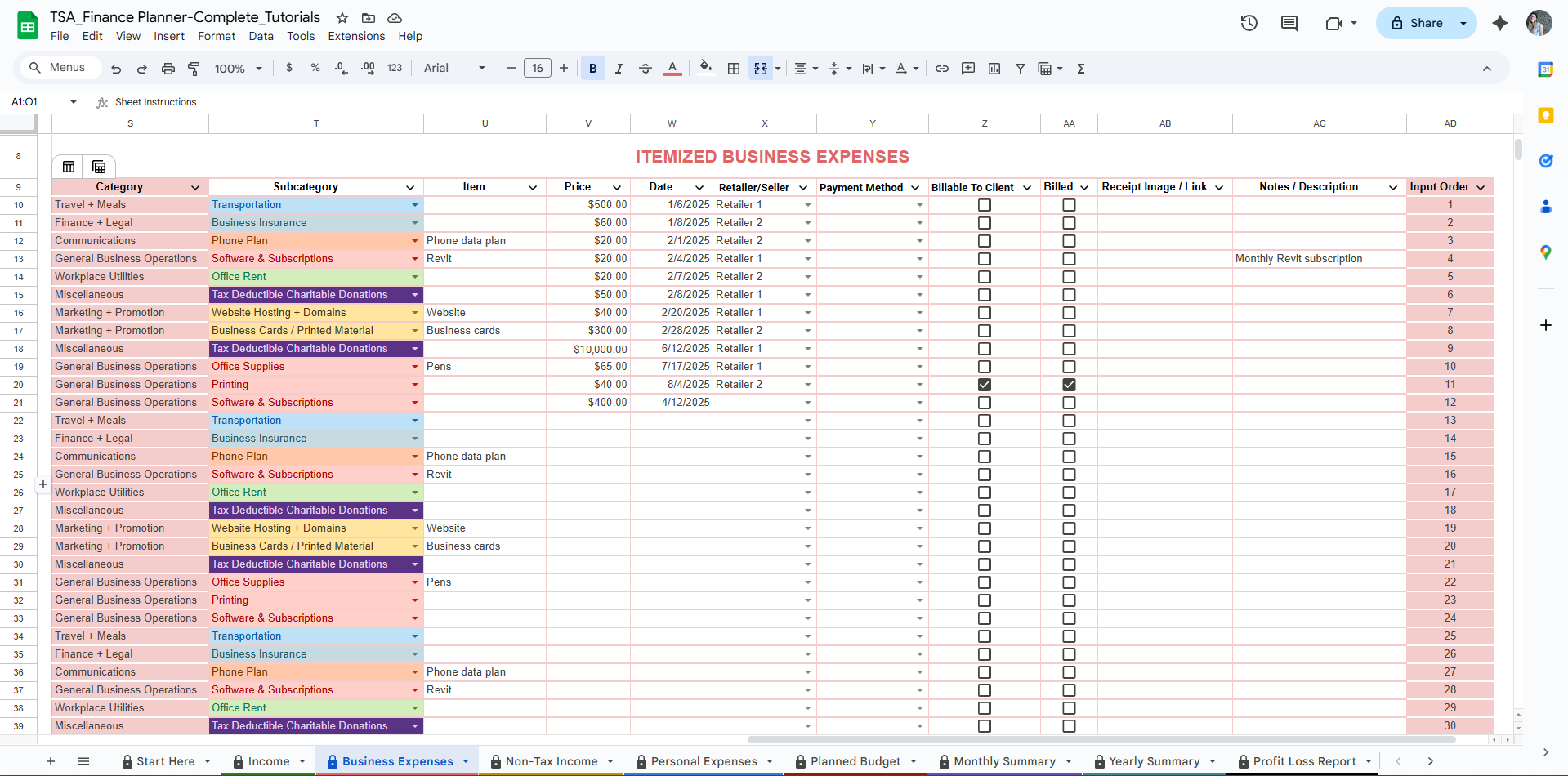

Expense Sheets

Business Expenses: Record any business-related purchases—from software subscriptions to supplies—to help with budgeting and tax prep.

Personal Expenses: Track your everyday personal spending to get a clear picture of where your money goes.

Each sheet includes:

A customizable dropdown section where you can tailor your categories, subcategories, retailers, and payment methods to match your real-life habits.

An itemized log section to document each transaction.

A yearly calendar view to see your finances month-by-month and spot trends at a glance.

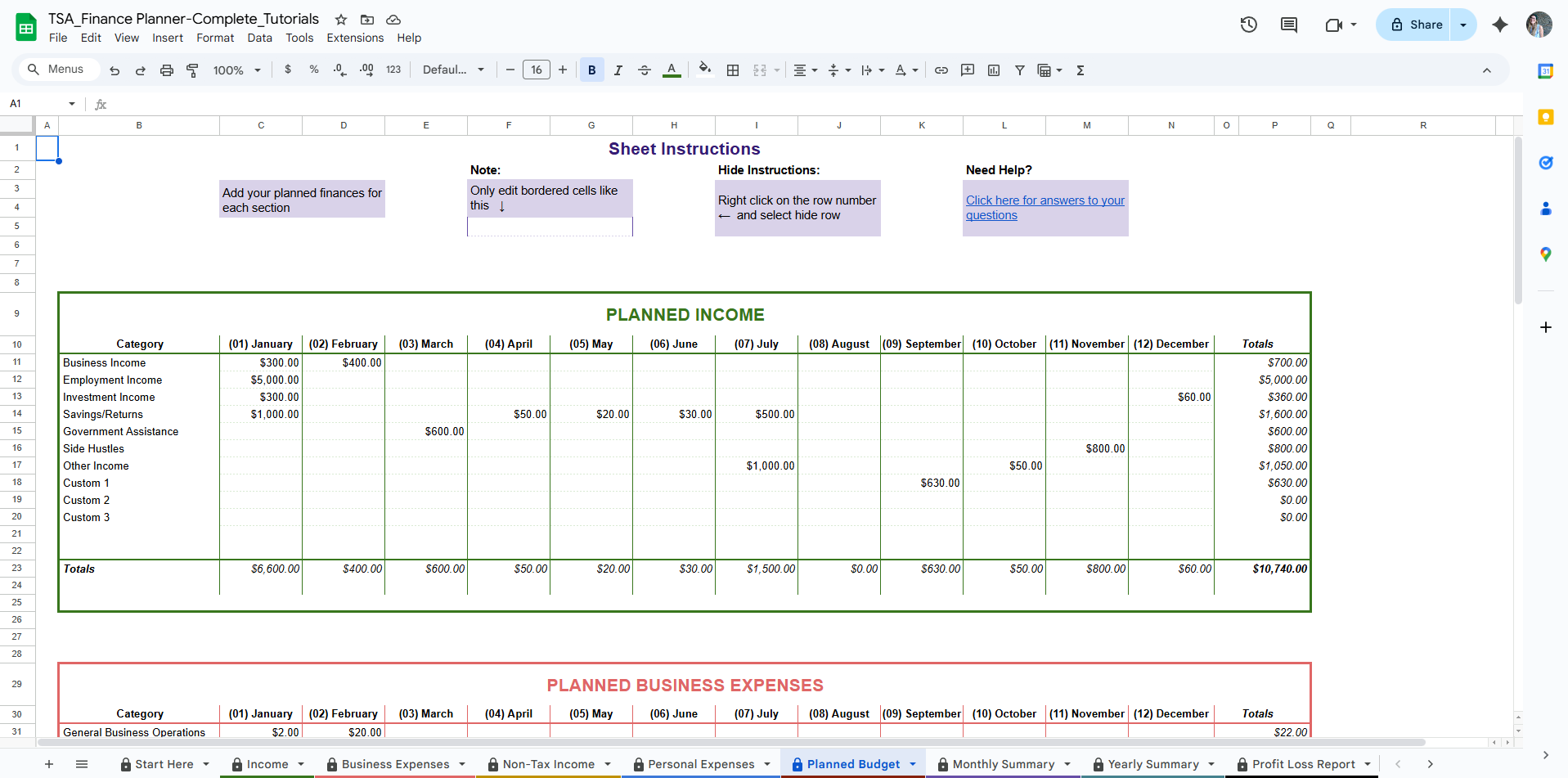

🧮 Planned Budget Sheet

This sheet helps you map out your finances ahead of time so you can make more intentional decisions about your spending and earning.

It’s organized into four sections to align with your actual financial tracking:

Planned Taxable Income – Estimate how much you expect to earn from freelance projects, your job, or other taxable sources.

Planned Non-Taxable Income – Plan for things like gifts, reimbursements, or other income that isn’t taxed.

Planned Business Expenses – Set monthly budgets for different business-related categories, such as software, marketing, or supplies.

Planned Personal Expenses – Estimate what you’ll spend on personal needs, from groceries to entertainment.

Each section includes:

A line for each category, where you can input what you expect to earn or spend each month.

Automatic totals by category and by month, giving you a clear view of your planned cash flow.

Use this sheet to plan for the year, track patterns, and stay in control of your financial goals.

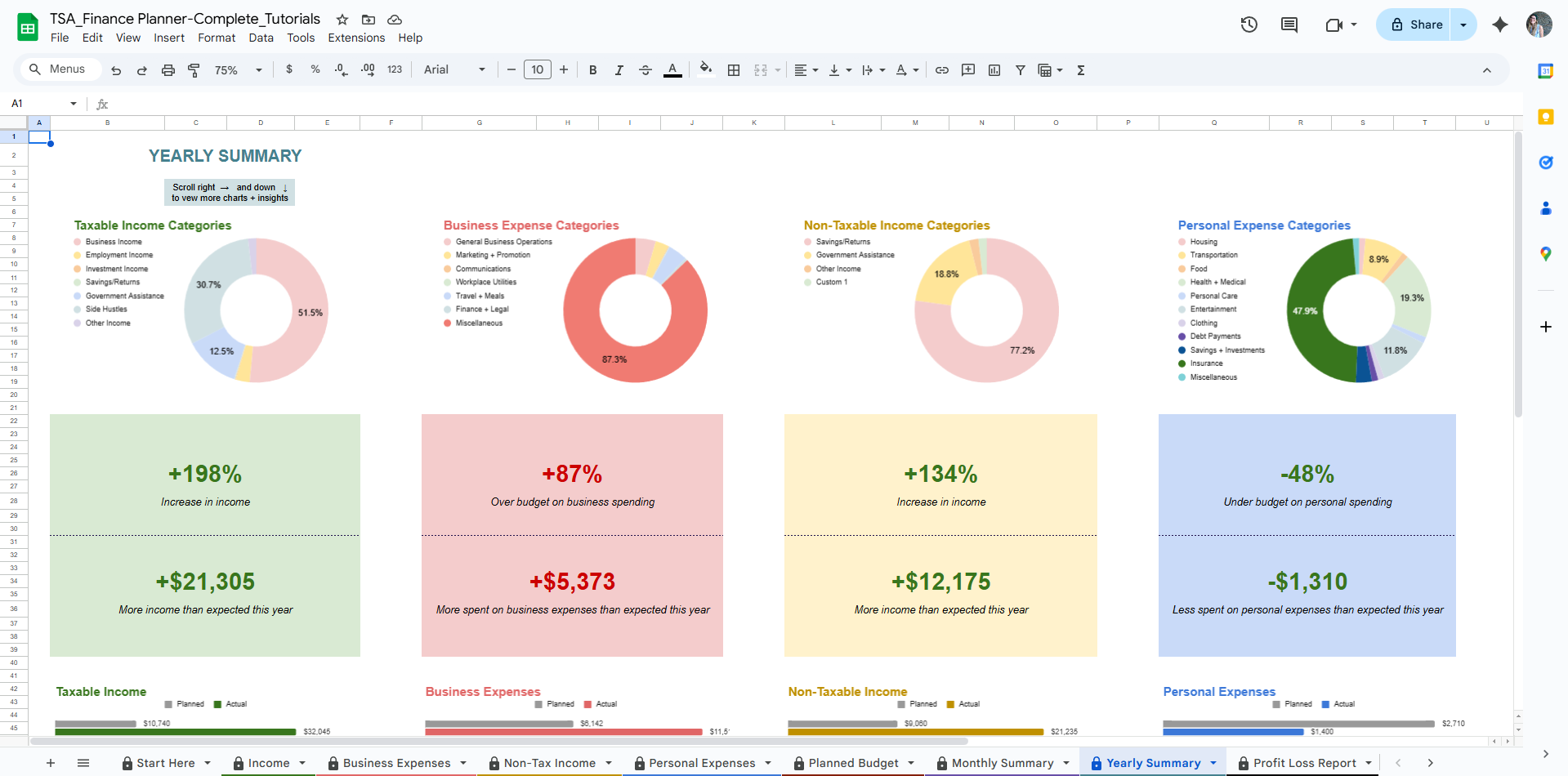

📊 Summaries + Insights

These auto-populated sheets do the heavy lifting for you.

Monthly Summaries: Show comparisons for income vs. expenses and planned vs. actual per month, with charts to visualize your cash flow.

Yearly Overview: Get a full visual snapshot of your year at a glance.

These sheets update automatically based on what you enter in the Planned Budget, Income, and Expense sheets.

💸 Tax Sheets

These sheets are designed to help you stay organized and proactive about your taxes—without needing to be a tax expert.

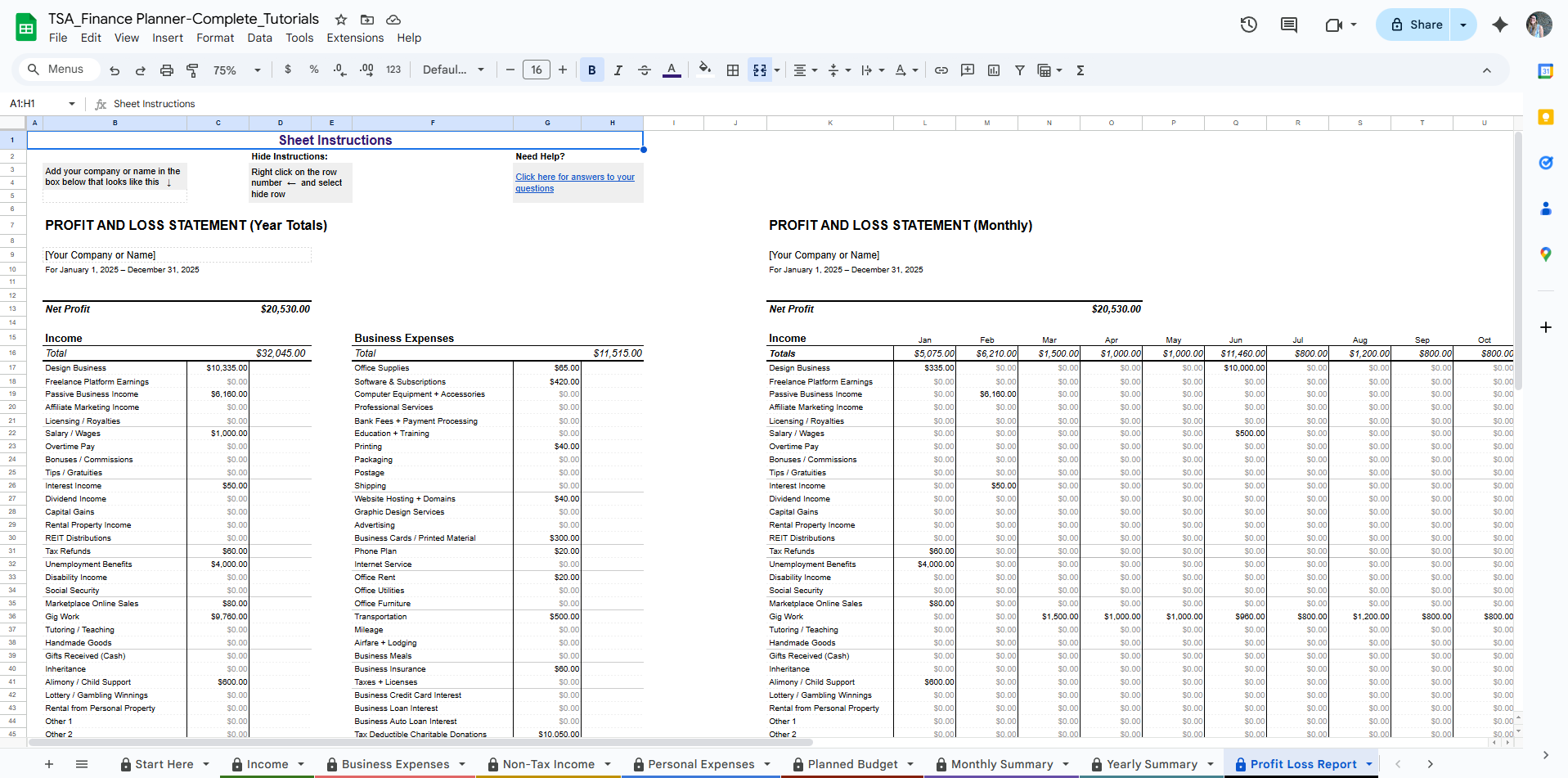

📊 Profit & Loss Report

This sheet automatically pulls data from your Income and Business Expense logs to show:

Your total taxable income and total business expenses

A breakdown of income and expenses by subcategory

Your net profit (income minus expenses)—helpful for tax reporting and tracking how your business is doing financially

This report is especially useful when you're preparing your taxes or applying for things like loans or grants.

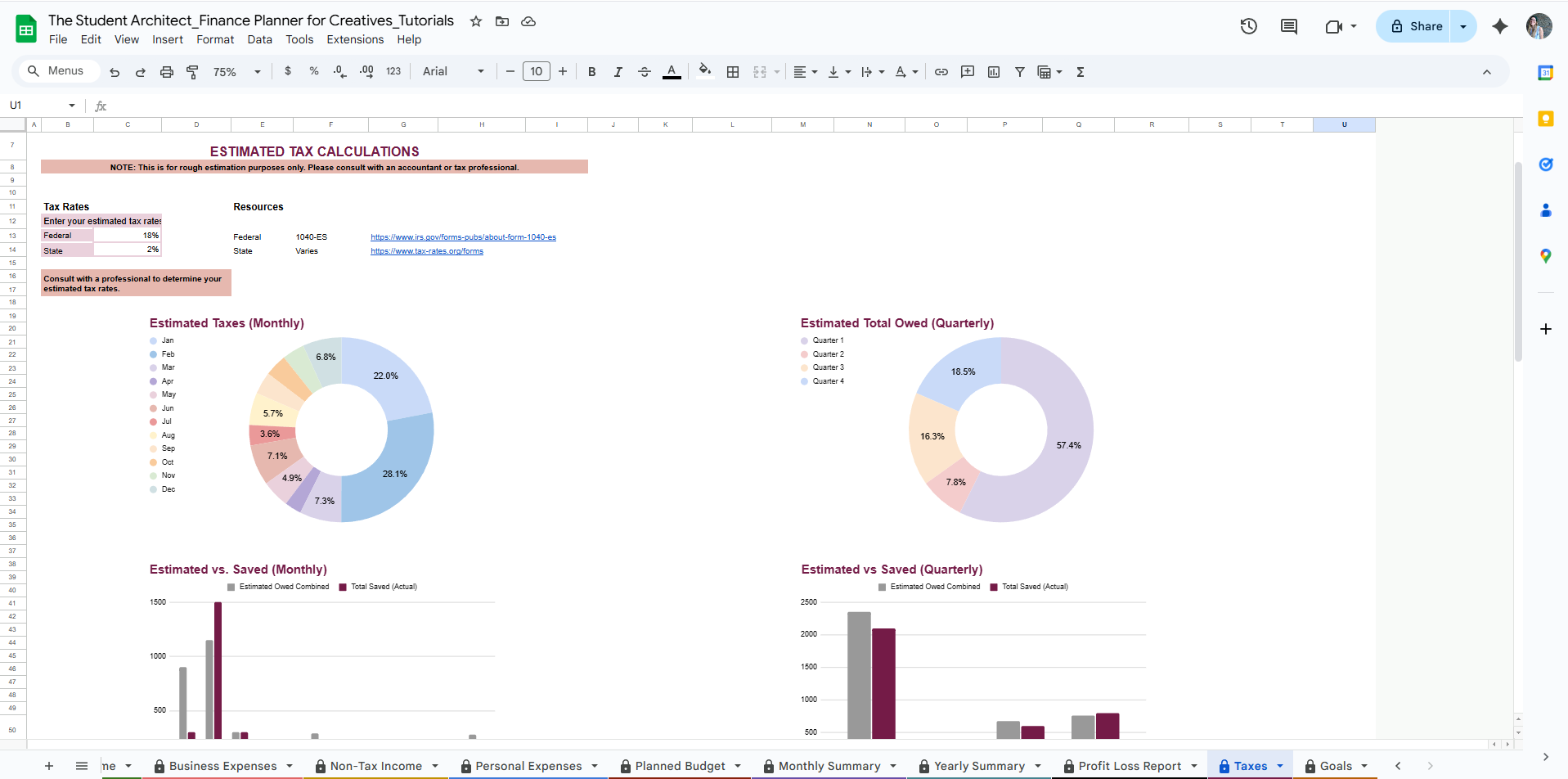

📅 Taxes Sheet

This is your central hub for estimating and tracking tax-related activity:

Estimate your quarterly taxes based on your actual income and expenses

See how much you need to save each month and quarter to stay on track

Track your tax savings: Document how much you’ve set aside each month

Record your federal and state tax dues and payments to keep everything in one place

These tools are especially helpful for freelancers and small business owners who want to avoid surprises and feel more in control during tax season.

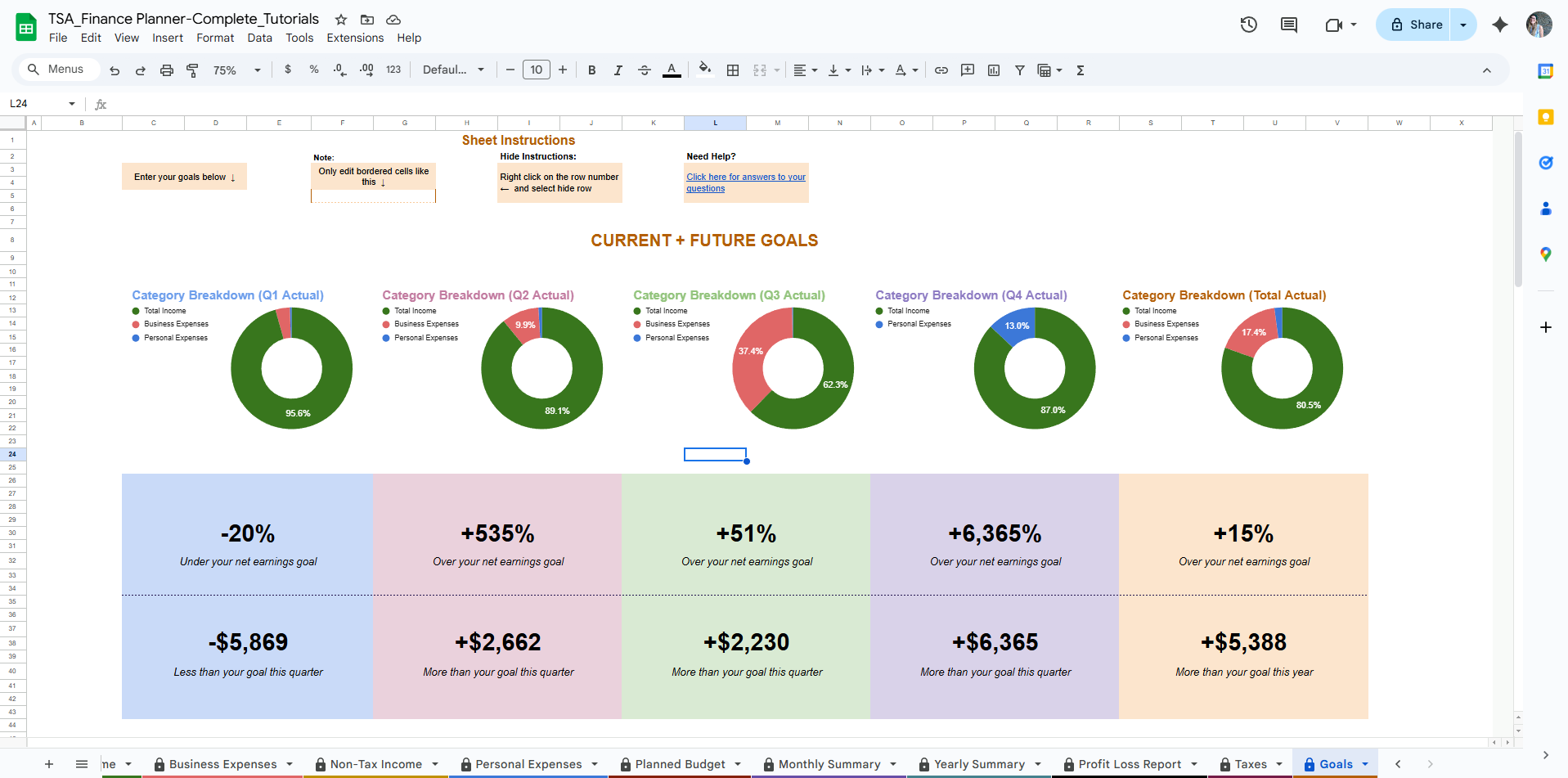

🎯 Goals Sheet

This section helps you set, track, and reflect on your financial goals—both short-term and long-term.

Current Goals: Define specific targets for each quarter (like savings or income goals) and see how your charts and insights update as you add data.

Top Goals: Record your big-picture 1-, 3-, 5-, and 10-year goals. These aren’t linked to calculations, but help you stay focused on your bigger vision.

Goal Prompts: Use these reflective prompts to spark ideas and clarify your priorities. Add custom responses and action steps to help you move forward.

This sheet is here to help you stay intentional with your finances and align your daily decisions with your long-term vision.