All Categories > Terms + Things > Terms of Use for the Finance Planner for Creatives

Terms of Use for the Finance Planner for Creatives

What you agree to when you purchase and use the Finance Planner for Creatives

These Terms of Use ("Terms") govern your purchase and use of the Finance Planner for Creatives ("Product") provided by Chelsea Weibust dba The Student Architect ("I", "me", or "the Creator"). By purchasing, downloading, or using this Product, you agree to these Terms.

Please read them carefully.

1. License and Use

You are granted a personal, non-exclusive, non-transferable license to use the Product for your own personal or business financial planning.

You may make copies of the files for your own use (e.g., backups), but sharing, distributing, reselling, or gifting the original Product, modified versions, or any part of it to others is strictly prohibited.

This Product is for use by you (and optionally your authorized partner or accountant) only. Unauthorized sharing or distribution is a violation of copyright.

Important: To ensure continued access, please save a copy of the Product to your personal Google Drive immediately after purchase. Access to product links or online files is not guaranteed indefinitely.

2. Third-Party Services and Limitations

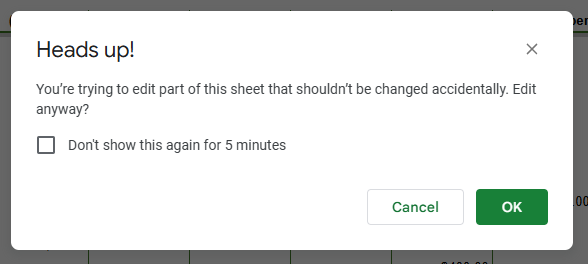

The Finance Planner for Creatives relies on third-party platforms such as Google Sheets for functionality and delivery.

I am not responsible or liable for any issues, outages, changes in service, data loss, or access limitations caused by Google or any other third-party services.

It is your responsibility to maintain backups of your files and ensure you have continued access by saving copies to your personal device or cloud storage.

3. No Professional Financial or Tax Advice

The Product is a tool to help you organize and plan your finances but does not constitute financial, tax, or legal advice.

You should consult a qualified professional regarding your specific financial, tax, or legal situation.

I am not responsible for any decisions or results you make based on using this Product.

4. Refunds and Cancellations

Due to the digital nature of the Product, all sales are final.

If you experience any issues accessing the Product, please contact me promptly here, and I’ll help resolve the issue.

5. User Responsibilities

You agree to use the Product lawfully and responsibly.

You acknowledge that you are responsible for regularly backing up your data.

6. Intellectual Property Rights

All rights, title, and interest in the Product (including text, design, formulas, and files) remain with me.

Unauthorized use or copying is prohibited and may result in legal action.

7. Disclaimer of Warranties and Limitation of Liability

The Product is provided "as is" without warranties of any kind.

I disclaim any liability for damages, losses, or issues arising from use or inability to use the Product.

You assume all risk associated with using this Product.

8. Changes to These Terms

I reserve the right to update or modify these Terms at any time.

Continued use of the Product constitutes acceptance of the updated Terms.

Any changes will be posted on this page with a revised “Last Updated” date.

9. Contact

If you have any questions about these Terms, you can reach out via email, just click here.